Future-Proofing Personal Finance with Quantum Machine Learning

At affordify.ai, we are committed to building the most advanced infrastructure for affordability scoring, behavioral profiling, and financial readiness

.png)

Pioneering the Future of Finance with Quantum-Enhanced AI

Quantum computing is set to transform high-dimensional learning and complex optimization — two domains at the heart of financial decision-making

Although quantum systems are still in early development, our internal research is laying the groundwork for hybrid AI systems capable of leveraging both classical and quantum resources

Why Quantum Machine Learning for Finance?

Personal finance presents unique challenges: irregular income patterns, high-dimensional behavior signals, complex credit optimization, and subtle risk indicators. Quantum machine learning introduces the possibility of solving these problems with greater speed, scale, and nuance than traditional systems

Our exploration is grounded in four core practices:

We are developing quantum-enhanced classifiers that map complex financial signals — such as multi-source cash flow irregularities — into quantum Hilbert spaces, where subtle behavioral separations become linearly distinguishable. This holds promise for more accurate modeling of emerging borrower profiles (e.g., freelancers, gig workers, or unbanked users)

Current Work: Prototype kernel-based quantum SVMs using Qiskit and PennyLane for non-linear separability testing in affordability scoring

Variational circuits are used to construct hybrid quantum-classical models that learn financial behavior directly from encoded user features. By combining classical preprocessing with quantum layers, we aim to reduce the parameter count while increasing model expressivity — a promising path for leaner, smarter decision systems

Current Work: Benchmarking variational quantum classifiers for binary affordability status prediction using simulator backends and near-term NISQ devices

Affinity modeling and cohort-based insights are essential for behavior-driven personal finance. We are testing quantum kNN algorithms that operate on quantum distance metrics, helping uncover user similarity patterns in sparse or noisy data — a common occurrence in self-reported or non-traditional financial data

Current Work: Implementation of quantum distance-based matching on synthetic gig economy data to evaluate group-based affordability pathways

Credit optimization and income allocation often boil down to hard combinatorial problems. Quantum annealing — a technique ideal for solving optimization landscapes — may one day enable real-time simulations of debt restructuring, savings prioritization, or cash flow planning

Current Work: Collaboration with quantum compute providers to simulate constrained financial optimization models via annealing-based solvers

Looking Ahead:

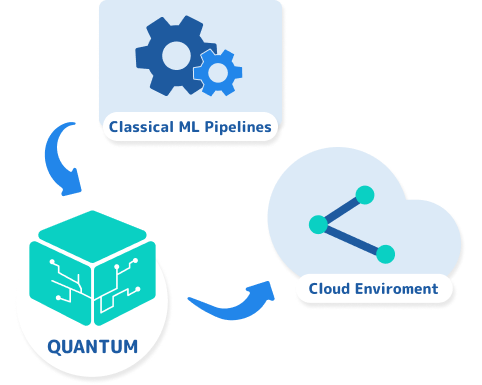

Hybrid-Ready Architecture

All quantum work at Affordify.ai is integrated with our classical ML pipelines through simulation environments and cloud-based quantum hardware (e.g., IBM Q, Amazon Braket)

This ensures we are positioned to seamlessly adopt quantum acceleration as soon as meaningful advantages emerge.While still early, our commitment is clear: to stay ahead of the curve in personal finance intelligence by investing in emerging computing paradigms that unlock smarter, fairer, and more responsive systems